Appraisals values at end-December 2023:

– €3.68 Bn excluding duties (i.e., cap rate of 5.10%)

– €3.89 Bn including duties (i.e., cap rate of 4.85%)

– The average remaining term of the leases at end-December 2023: 5.7 years fixed

Gross financial debt at end-December 2023: €1.9bn

55% of fixed-rate bond

40% Hedged variable rates

5% Floating rate debt

– EPRA Loan to Value at end-December 2023: 49.7%

– EPRA NAV NRV at end-December 2023: €2.091 Bn, i.e., €90.6 / share

– EPRA NAV NTA at end-December 2023: €1.827 Bn, i.e., €79.1 /share

– EPRA NAV NDV at end-December 2023: €1.930 Bn, i.e., €83.6 /share

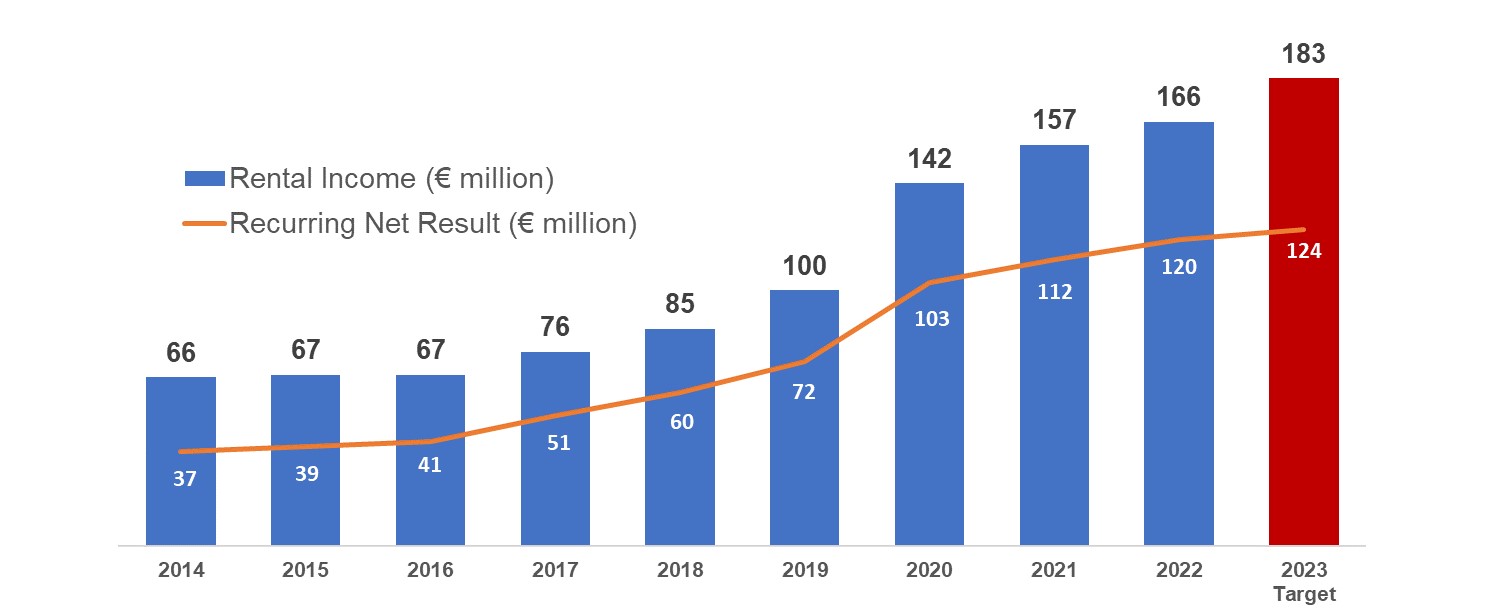

Argan’s updated targets to by end–2024:

– Rental income: €197m

– Recurring net Income – Group share: €133m

Regulated information

Argan has been listed on Euronext Paris since June 2007, on the A compartment of Euronext Paris. Argan is included in the CAC All-Shares, IEIF SIIC France and EPRA Europ indices. As of 1 July 2007, the Company opted for the SIIC tax regime

Place of cotation : Euronext Paris

ISIN: FR0010481960

Ticker: ARG

Number of shares at end-January 2024: 23,092,378